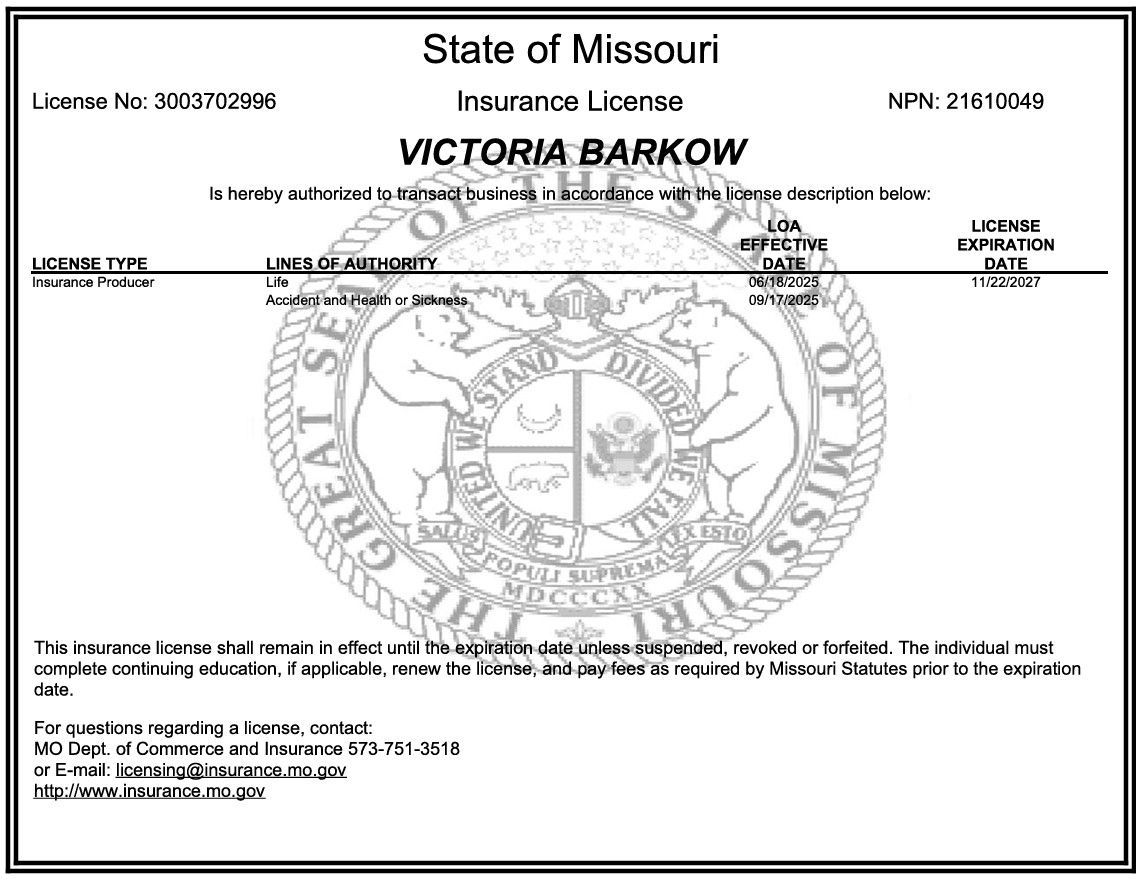

Easy Life Insurance for Springfield, MO

Not Sure Where to Start?

Start by describing your concerns below, then one of our Springfield professional experts will help you.

Contact Us

Helping Springfield Families Build Security That Lasts

Life evolves swiftly, yet peace of mind should always remain attainable. We assist families in Springfield in prioritizing what truly matters. Every policy we provide is centered on stability, empathy, and community support. Whether it’s safeguarding income, addressing final costs, or fostering savings, we steer individuals toward informed choices. You deserve coverage that aligns with your current life and nurtures your loved ones in the future. Here in Springfield, we are dedicated to empowering our neighbors to secure their future with transparency and confidence.

We offer a comprehensive set of products tailored to meet your needs, such as:

- Term Life Insurance

- Whole Life Insurance

- Burial Insurance

- Life Insurance for Seniors

- Mortgage Protection Life Insurance

- Income Protection Life Insurance

- Annuities

Request Recommendation

Peace of Mind for the "if" in Life

Burial Insurance

Burial insurance helps cover Springfield funeral and final expenses so loved ones aren’t left with financial stress. It’s a thoughtful choice for those who want to plan ahead and ensure dignity and care are maintained.

General Life Insurance

General life insurance offers flexible, straightforward coverage. It’s ideal for people who want protection that adapts to changing goals. Policies can support Springfield family needs, debt repayment, or estate planning

Best Value Insurance

Best Value Insurance balances coverage and cost for practical, full-spectrum protection. It focuses on giving dependable benefits at competitive rates. This plan helps our Springfield neighbors get strong protection without overpaying. The emphasis is on clarity, fairness, and long-term satisfaction.

Life Insurance for Seniors

Life insurance for Springfield seniors focuses on simplicity, value, and ease of approval. Many plans require no medical exam and provide quick coverage. It can help cover medical bills, debts, or final expenses. Seniors gain lasting peace of mind knowing their Springfield families are protected, and important matters are already handled.

IULs for Springfield

IULs are a unique way to invest your hard-earned money with high growth potential, with tax advantages.

Mortgage and Income Protection

These solutions ensure your home and lifestyle stays secure if something happens to the person responsible for payments. It can pay off or reduce mortgage debt, or replace. Income protection insurance replaces a portion of income if illness or injury prevents work. It’s one of the smartest ways to keep financial plans on track when life takes a turn.

Term Life Insurance

Term life insurance offers simple, affordable coverage for a set period. It’s a strong choice for Springfield families looking to protect income or cover major expenses like mortgages or tuition. If the unexpected happens during the term, benefits go directly to your chosen beneficiaries. When the term ends, you can renew or explore other coverage. It’s flexible protection that gives peace of mind without long-term cost.

Whole Life Insurance

Whole life insurance provides lifelong protection and steady cash value growth. Many in Springfield choose this for its reliability and long-term benefits. Premiums stay consistent, and the policy builds value over time. It can help fund future needs or act as a lasting gift for loved ones. Whole life insurance brings both security and savings together in one simple plan.

Annuities

Annuities create steady income during retirement. They’re designed for people who want dependable payments they can count on for life. Options include fixed or flexible payouts, giving control over how funds grow and are received. Annuities are a foundation for long-term stability, turning savings into guaranteed income and ensuring retirement confidence in Springfield, MO.

Why Choose Us, Springfield?

Choosing a life insurance partner is about more than paperwork — it’s about confidence. Every conversation focuses on what matters most to the individual, not on sales or pressure. We take time to explain each option so that decisions feel simple, not overwhelming.

Whether you’re starting a family, planning for retirement, or protecting a home, we are here to guide the way with honesty, clarity, and respect.